Palantir filed an S-1 confidentially to the SEC in early July, but we have so far been waiting for the final document to be published for weeks now with nary a murmur. Now, thanks to some leaked screenshots to TechCrunch from a Palantir shareholder, we might have some top-line numbers.

Full-year revenues and losses

In screenshots of a draft S-1 statement dated yesterday (August 20), Palantir is listed as generating revenues of roughly $742 million in 2019 (Palantir’s fiscal year is a calendar year). That revenue was up from $595 million in 2018, a gain of roughly 25%. That’s growth, although not particularly great, given some of the massive SaaS growth we have seen in recent IPOs like Datadog.

The company’s revenue is a disappointment, after the company was reported to have been on the cusp of $1 billion in revenue for years. Private companies, of course, do not normally disclose their financial results, but the company’s size falls far short of expectations, leaks and other reports.

The real shocker though in these numbers is when you head to the bottom of the company’s revenue statement. In the screenshots of the company’s financials, Palantir lists a net loss of roughly $580 million for 2019, which is almost identical to its loss in 2018. The company listed a net loss percentage of 97% for 2018, improving to a loss of 78% for last year.

The company’s $580 million loss during the period shows at once why the company has needed to raise billions to date, and how far it has yet to go until it can self-sustain.

Gross profit for 2019 was roughly $500 million, about 16% higher than in 2018. The company’s big expense is around sales and marketing, which was roughly $450 million for both years and represented 61% of revenue in 2019.

First half of 2020 is looking slightly better

The story gets a little better in 2020. For the first six months of 2020, Palantir recorded revenues of $481 million, a 49% gain compared to the same period last year. More importantly, Palantir has worked hard to maintain its level of expenses in sales and marketing, research and development as well as general and administrative costs.

Palantir kept expenses in check in the first half of 2020 despite its increase in revenue. In relative numbers, operating expenses changed from 157% of revenues in the first half of 2019 to 107% of revenues in the first half of 2020.

To be clear, that is still really high for a 17-year-old company.

Palantir is increasingly a government contractor, despite attempts to enter the commercial arena

The company’s revenue breakdown is particularly interesting because it finally answers the question about how much it relies on government contracts and if it’s trying to diversify. Palantir is widely known for its government contracting, but in recent years, the company has tried to expand its data products into the private sector.

According to the leaked screenshots shown to TechCrunch, Palantir disclosed its revenue breakdown for the first six months of 2019 and the first six months of 2020. For the first half of this year, Palantir generated $258 million in government-derived revenue (53.5%), compared to $224 million in commercial revenue (46.5%). In 2019, government revenue was $146 million (45%) and commercial revenue was $177 million (55%). Together, that means that government revenue increased by 76%, versus just 27% growth in its commercial business.

That’s actually quite out-of-sync with some of the public comments the company has made about reducing reliance on government contracts for its revenues. The company’s government revenues are higher today both in absolute totals and relatively speaking, begging the question whether its products are competitive in the enterprise space outside of its traditional bastion in government services.

What’s interesting is that almost all of that revenue growth is from existing customers (dated to the end of 2019) rather than new customers in 2020 (despite all that S&M spending). On the government side, $102 million of the $112 million revenue increase (91%) came from existing clients, while $43 million of the $47 million of growth in commercial revenues (91% as well) came from existing customers.

In other words, Palantir remains heavily reliant on its existing customer base — and particularly its government clients — for new growth.

While there is no firm date for the Palantir S-1 that we know of, given the financials are apparently floating around out there, expect it to come sooner rather than later.

We reached out to a Palantir PR contact, who declined to comment.

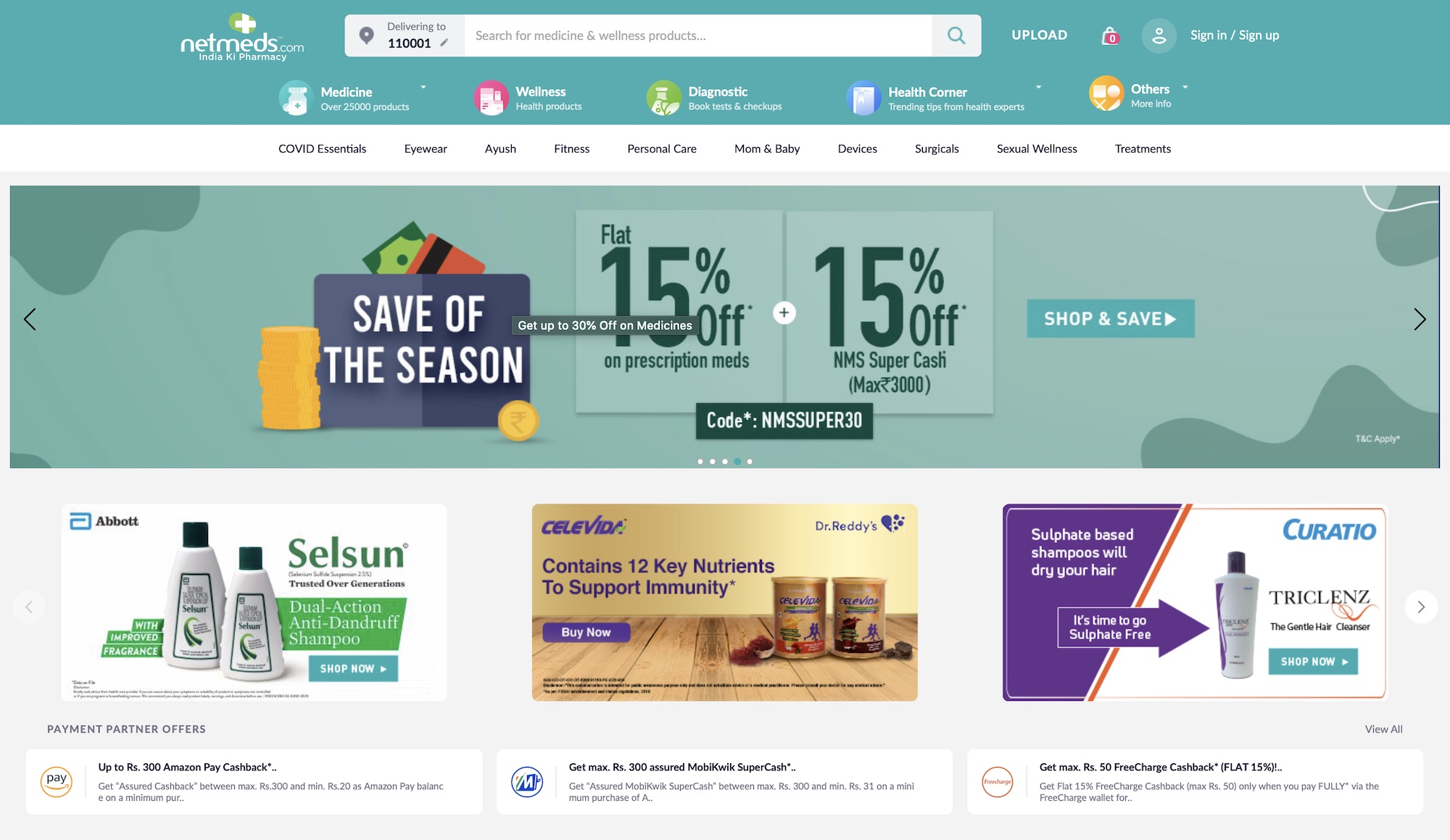

Netmeds is one of the largest online pharmacies in India (Image: Netmeds)

Netmeds is one of the largest online pharmacies in India (Image: Netmeds)